-

Matterport Announces First Quarter 2022 Financial Results with Stronger-than-Expected Revenue

المصدر: Nasdaq GlobeNewswire / 10 مايو 2022 16:05:01 America/New_York

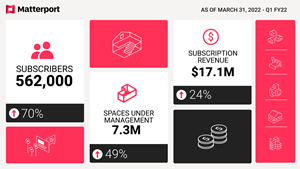

- Total subscribers increased 70% to 562,000 from year-ago period

- Subscription revenue rose 24% year-over-year

- Q1 GAAP diluted earnings per share of $0.23, Non-GAAP loss per share of $0.10

- Company reaffirms prior guidance for the full year

- Balance sheet remains strong with $600 million cash and investments and no debt

SUNNYVALE, Calif., May 10, 2022 (GLOBE NEWSWIRE) -- Matterport, Inc. (Nasdaq: MTTR) (“Matterport” or the “Company”), the leading spatial data company driving the digital transformation of the built world, today announced financial results for the quarter ended March 31, 2022.

“We are pleased to report another strong quarter, increasing our subscriber count by 70% to 562,000 subscribers for the period. We expanded Spaces Under Management by 49% to 7.3 million spaces — that’s 7.3 million Matterport digital twins of homes, offices, factories, hotels, and so much more,” said RJ Pittman, Chairman and Chief Executive Officer of Matterport. “Real property is the largest asset class in the world, now valued at an estimated $327 trillion, reflecting a $100 trillion increase in value in recent years as more than 15,000 new buildings are completed every day. Matterport is leading the industry with over 7 million digital twins, and we’re creating thousands more each day, while 99% of the world's buildings have yet to be digitized. This enormous market opportunity is expanding, and we remain focused on efficiently scaling Matterport’s business to meet the rising global demand for software-driven property management.”

“In addition to strong adoption, we are excited to report our total revenue for the first quarter of 2022 was $28.5 million, $1 million above the high end of our guidance range. In addition, Non-GAAP loss per share of 10 cents for the quarter was three cents better than the top end of our guidance range,” said JD Fay, Chief Financial Officer of Matterport. “One of our key strategic levers is subscription revenue, which increased by 24% year-over-year, comprising over 60% of total revenue for the quarter, and which continues to provide high and stable gross margins. Today, we are re-affirming our prior 2022 revenue and EPS guidance. With $600 million of cash on our balance sheet, we have the financial strength to navigate the macro environment and comfortably achieve our long term business plan,” he added.

First Quarter 2022 Financial Highlights

- Total revenue was $28.5 million, up 6% compared to first quarter of 2021

- Subscription revenue was $17.1 million, up 24% compared to first quarter of 2021

- Annualized Recurring Revenue (ARR) of $68.6 million

- Total subscribers increased to 562,000, up 70% compared to first quarter of 2021

- Spaces Under Management (SUM) grew to 7.3 million, up 49% compared to first quarter of 2021

Recent Business Highlights

- Matterport Axis™, a motorized mount for smartphones, is now available for purchase. Matterport Axis, which holds either an iOS or Android device, and can be used with the Matterport Capture app, creates 3D digital twins of any physical space with increased speed, precision, and consistency

- Announced Midland Holdings, one of the largest residential real estate brokerages in the Greater China region, will become the first brokerage in the region to use Matterport digital twins to create virtual 3D experiences for its entire portfolio of properties

- Expanded its presence in the Brazilian market via two strategic partners, Guandalini Posicionamento and PARS, to offer Matterport's spatial data platform to their enterprise customers in the architecture, engineering, and construction (AEC) markets.

- Announced and completed the acquisition of Enview, Inc., a pioneer in the scalable, artificial intelligence (AI) for 3D spatial data

- Announced the redemption of public warrants, resulting in approximately $104 million in cash proceeds from the warrants prior to redemption

- Launched social impact program to support nonprofits and public education institutions by enabling equitable access to 3D spaces

- Won two Comparably Awards, including Best Company Outlook among small/mid-sized companies and Best Places to Work in the San Francisco Bay Area

- Strengthened Matterport’s executive team through the addition of the following executives:

- Tom Klein, Chief Marketing Officer

- Deepti Illa, Vice President, Global Integrated Marketing

- Ali Jayson, Vice President, Product Marketing

- Florence Shaffer, Vice President, Strategy & Operations, Chief of Staff to CEO

- Ben Corser, Managing Director, Asia Pacific

- Rob Hines, Managing Director, Americas

Full Year and Second Quarter 2022 Outlook

Q2 2022 Guidance FY 2022 Guidance Revenue (in millions) $28.5 — $30.5 $125 — $135 Subscription Revenue (in millions) $18.0 — $18.3 $80 — $82 Year-over-year Subscription Revenue growth 18% - 20% 31% - 34% Non-GAAP loss per share ($0.13) - ($0.15) ($0.47) - ($0.52) Fully diluted shares outstanding (in millions) 284 285 Non-GAAP Financial Information

Matterport has provided in this press release financial information that has not been prepared in accordance with generally accepted accounting principles in the United States (GAAP). We believe that the presentation of non-GAAP financial information provides important supplemental information to management and investors regarding financial and business trends relating to Matterport’s financial condition and results of operations.

The presentation of these non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with the Company’s consolidated financial statements prepared in accordance with GAAP. For further information regarding these non-GAAP measures, including the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, please refer to the financial tables below.

Non-GAAP Net Loss and Non-GAAP Net Loss Per Share, Basic and Diluted. Matterport defines non-GAAP net loss as net income (loss), adjusted to exclude stock-based compensation expense, fair value change of warrants liabilities, fair value change of earn-out liabilities, payroll tax related to contingent earn-out share issuance, acquisition transaction costs, and amortization of acquired intangible assets, in order to provide investors and management with greater visibility to the underlying performance of Matterport’s recurring core business operations. In order to calculate non-GAAP net loss per share, basic and diluted, Matterport uses a non-GAAP weighted-average share count. Matterport defines non-GAAP weighted-average shares used to compute non-GAAP net loss per share, basic and diluted, as GAAP weighted average shares used to compute net income (loss) per share attributable to common stockholders, basic, adjusted to reflect the shares of Matterport’s Class A common stock exchanged for the previously issued and outstanding shares of redeemable convertible preferred stock and common stock warrants of Matterport, Inc. (now known as Matterport Operating, LLC) in connection with the recently completed merger, that are outstanding as of the end of the period as if they were outstanding as of the beginning of the period for comparability, and the potentially dilutive effect of the Company’s employee equity incentive plan awards.

Conference Call Information

Matterport will host a conference call for analysts and investors to discuss its financial results for the first quarter of fiscal 2022 today at 1:30 p.m. Pacific time (4:30 p.m. Eastern time). A recorded webcast of the event will also be available following the call for one year on the Matterport’s Investor Relations website at investors.matterport.com.

About Matterport

Matterport, Inc. (Nasdaq: MTTR) is leading the digital transformation of the built world. Our groundbreaking spatial data platform turns buildings into data to make nearly every space more valuable and accessible. Millions of buildings in more than 177 countries have been transformed into immersive Matterport digital twins to improve every part of the building lifecycle from planning, construction, and operations to documentation, appraisal and marketing. Learn more at matterport.com and browse a gallery of digital twins.

©2022 Matterport, Inc. All rights reserved. Matterport is a registered trademark and the Matterport logo is a trademark of Matterport, Inc. All other marks are the property of their respective owners.

Forward-Looking StatementsThis press release contains certain forward-looking statements within the meaning of the federal securities laws, including statements regarding the services offered by Matterport, Inc. and the markets in which Matterport operates, business strategies, debt levels, industry environment including relating to the global supply chain, potential growth opportunities, the effects of regulations and Matterport’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “forecast,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions (including the negative versions of such words or expressions).

Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including Matterport’s ability to implement business plans, forecasts, and other expectations in the industry in which Matterport competes, and identify and realize additional opportunities. The foregoing list of factors is not exhaustive. In addition, the financial results set forth in this press release are preliminary and unaudited, and are based on information currently available to the Company. While the Company believes these financial results are meaningful, they could differ from the audited results that the Company reports in its Annual Report on Form 10-K for the fiscal year ended December 31, 2021. The Company assumes no obligation and does not intend to update these unaudited financial results prior to filing its Form 10-K for the fiscal year ended December 31, 2021. You should carefully consider the foregoing factors and the other risks and uncertainties described in documents filed by Matterport from time to time with the U.S. Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Matterport assumes no obligation and, except as required by law, does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Matterport does not give any assurance that it will achieve its expectations.

Investor Contact:

Soohwan Kim, CFA

VP, Investor Relations

ir@matterport.comMedia Contact:

Tim McDowd

Director, Communications

press@matterport.com

+1 (650) 273-6999MATTERPORT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)Three Months Ended

March 31,2022 2021 Revenue: Subscription $ 17,141 $ 13,800 License 23 2,260 Services 3,973 2,689 Product 7,373 8,180 Total revenue 28,510 26,929 Costs of revenue: Subscription 5,262 3,251 License — — Services 2,983 2,035 Product 8,356 4,915 Total costs of revenue 16,601 10,201 Gross profit 11,909 16,728 Operating expenses: Research and development 26,002 6,025 Selling, general, and administrative 70,849 13,058 Total operating expenses 96,851 19,083 Loss from operations (84,942 ) (2,355 ) Other income (expense): Interest income 1,295 8 Interest expense — (308 ) Change in fair value of warrants liabilities 21,433 — Change in fair value of contingent earn-out liability 136,043 — Other expense, net (1,321 ) (198 ) Total other income (expense) 157,450 (498 ) Income (loss) before provision for income taxes 72,508 (2,853 ) Provision for income taxes 604 19 Net income (loss) $ 71,904 $ (2,872 ) Net income (loss) per share attributable to common stockholders: Basic $ 0.26 $ (0.07 ) Diluted $ 0.23 $ (0.07 ) Weighted-average shares used in computing net income (loss) per share attributable to common stockholders: Basic 275,199 39,632 Diluted 312,432 39,632 MATTERPORT INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)March 31, December 31, 2022 2021 ASSETS Current assets: Cash and cash equivalents $ 92,996 $ 139,519 Restricted cash — 468 Short-term investments 308,813 264,931 Accounts receivable, net 15,088 10,879 Inventories 5,166 5,593 Prepaid expenses and other current assets 14,213 16,313 Total current assets 436,276 437,703 Property and equipment, net 21,946 14,118 Operating lease right-of-use assets 3,369 — Long-term investments 198,178 263,659 Goodwill 54,080 — Intangible assets, net 5,140 — Other assets 2,912 3,696 Total assets $ 721,901 $ 719,176 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities Accounts payable $ 13,089 $ 12,227 Deferred revenue 14,270 11,074 Accrued expenses and other current liabilities 21,763 10,026 Total current liabilities 49,122 33,327 Warrants liability 6,405 38,974 Contingent earn-out liability — 377,576 Deferred revenue, non-current 288 874 Other long-term liabilities 6,448 262 Total liabilities 62,263 451,013 Commitments and contingencies Redeemable convertible preferred stock $ — $ — Stockholders’ equity: Common stock 28 25 Additional paid-in capital 1,061,938 737,735 Accumulated other comprehensive loss (6,174 ) (1,539 ) Accumulated deficit (396,154 ) (468,058 ) Total stockholders’ equity 659,638 268,163 Total liabilities and stockholders’ equity $ 721,901 $ 719,176 MATTERPORT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands, unaudited)Three Months Ended March 31, 2022 2021 CASH FLOWS FROM OPERATING ACTIVITIES Net income (loss) $ 71,904 $ (2,872 ) Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: Depreciation and amortization 2,463 1,285 Amortization of debt discount — 67 Amortization of investment premiums, net of accretion of discounts 954 — Stock-based compensation, net of amounts capitalized 55,277 658 Change in fair value of warrants liabilities (21,433 ) — Change in fair value of contingent earn-out liability (136,043 ) — Deferred income taxes (227 ) — Allowance for doubtful accounts 191 16 Other 45 (53 ) Changes in operating assets and liabilities, net of effects of businesses acquired: Accounts receivable (3,988 ) (722 ) Inventories 427 185 Prepaid expenses and other assets (1,571 ) (144 ) Accounts payable 659 1,869 Deferred revenue 2,610 1,787 Accrued expenses and other liabilities 3,254 (1,020 ) Net cash provided by (used in) operating activities (25,478 ) 1,056 CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of property and equipment (448 ) (162 ) Capitalized software and development costs (3,596 ) (1,344 ) Purchase of investments (30,378 ) — Maturities of investments 46,200 — Investment in convertible notes — (1,000 ) Business acquisitions, net of cash acquired (30,020 ) — Net cash used in investing activities (18,242 ) (2,506 ) CASH FLOW FROM FINANCING ACTIVITIES: Payment of transaction costs related to reverse recapitalization — (593 ) Proceeds from exercise of stock options 2,191 789 Payments for taxes related to net settlement of equity awards (33,337 ) — Proceeds from exercise of warrants 27,844 — Repayment of debt — (1,099 ) Other 76 — Net cash used in financing activities (3,226 ) (903 ) Net change in cash, cash equivalents, and restricted cash (46,946 ) (2,353 ) Effect of exchange rate changes on cash (45 ) (12 ) Cash, cash equivalents, and restricted cash at beginning of year 139,987 52,250 Cash, cash equivalents, and restricted cash at end of period $ 92,996 $ 49,885 MATTERPORT, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, except per share amounts)

(unaudited)Three Months Ended March 31, 2022 2021 GAAP net income/(loss) $ 71,904 $ (2,872 ) Stock-based compensation expense (1) 56,088 658 Acquisition-related costs (2) 172 — Amortization expense of acquired intangible assets 260 — Change in fair value of warrants liabilities (3) (21,433 ) — Change in fair value of contingent earn-out liability (4) (136,043 ) — Payroll tax related to contingent earn-out share issuance (5) 1,164 — Non-GAAP net loss $ (27,888 ) $ (2,214 ) GAAP net income (loss) per share attributable to common stockholders: Basic $ 0.26 $ (0.07 ) Diluted $ 0.23 $ (0.07 ) Non-GAAP net loss per share attributable to common stockholders, basic and diluted $ (0.10 ) $ (0.01 ) GAAP weighted-average shares used to compute net income (loss) per share, basic 275,199 39,632 Weighted-average effect of potentially dilutive securities (6) 37,233 — GAAP weighted-average shares used to compute net income (loss) per share, diluted 312,432 39,632 Excluded anti-dilutive weighted-average potential shares of common stock in calculating non-GAAP loss per share (37,233 ) — Adjustment for common stock issued in connection with the merger (7) — 127,499 Non-GAAP weighted-average shares used to compute net loss per share, basic and diluted 275,199 167,131 (1) Consists primarily of non-cash share-based compensation related to the Company's stock incentive plans and earn-out arrangement.

(2) Consists of acquisition transaction costs.

(3) Consists of the non-cash fair value measurement change for public and private warrants.

(4) Represents the non-cash fair-value measurement change related to our earn-out liability.

(5) Represents the payroll tax related to Earn-out shares issuance and release.

(6) Consists of the potentially dilutive effect of employee equity incentive plan awards.

(7) Consists of non-GAAP adjustment of unweighted average common stock issued and converted from Matterport, Inc.’s (now known as Matterport Operating, LLC) previously issued and outstanding shares of convertible preferred stock and common stock warrants prior to the completion of the merger.

A photo accompanying this announcement is available at

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4034e15b-6368-40be-95e9-26432d54e28c